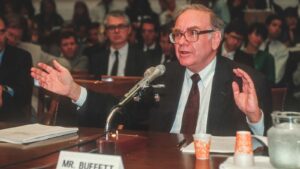

Starting out as an investor can be intimidating. As legendary investor Warren Buffett put it, there are two important rules to follow: One, don’t lose money. And two, remember rule number one.

Of course, this is easier said than done, especially with hundreds of stocks to choose from. Often times, one can be left with a headache trying to distinguish good stocks from bad and trying to build a portfolio from scratch.

When in doubt keep things simple and start with familiar equities that can serve as the foundation of a long-term investment fund. Fortunately, there are some exceptional companies whose stocks have outperformed the market for decades and are likely to continue doing so. These are growing companies that have unique businesses, strong competitive positions, wide protective moats, and focus on shareholder returns. What are the best stocks for beginners to buy now? Here are three picks.

Berkshire Hathaway (BRK.A/BRK.B)

Former hedge fund manager turned analyst Whitney Tilson likes to call Berkshire Hathaway (NYSE:BRK.A/NYSE:BRK.B) “America’s number one retirement stock.” Tilson says he thinks Berkshire’s more affordable Class B stock should form the basis of any conservative investment portfolio because it offers a rare combination of safety and growth. In this regard, Tilson is bang on. Few stocks have grown as steadily and with less drama over the years than the holding company of Warren Buffett.

Berkshire Hathaway today holds an impressive number of well-known and diverse businesses that range from the Dairy Queen restaurant chain and Fruit of the Loom clothing company to BNSF railway and Geico insurance. Berkshire also manages an investment portfolio that is worth nearly $360 billion and holds mostly blue-chip stocks such as Coca-Cola (NYSE:KO) and American Express (NYSE:AXP). The end result is that BRK.B stock continues to grow at a steady clip, having gained 16% this year and 65% over the last five years.

Costco (COST)

Warehouse club and big box retailer Costco (NASDAQ:COST) is a company that is both familiar to people and easy to understand. It’s also a stock that has an established track record of providing shareholders with consistent gains and dividends. This year COST stock is up 30%, lifting its five year appreciation to 157%. The company’s quarterly dividend isn’t huge at a $1.02 per share for a yield of 0.69%. But Costco also has a record of paying special one-time dividends. Its last one was $10 a share paid in late 2020.

Owing to the essential nature of the groceries and gasoline that Costco sells, its stock tends to perform well in any economic cycle. Good times or bad, people continue to shop for the items they and their family needs at Costco. This has made COST stock another reliable investment that people can hold for the long term. Now is a good time for people to purchase shares of Costco as the company undergoes a change of CEO and charts its future direction.

Microsoft (MSFT)

If there’s such thing as a blue-chip tech stock, Microsoft (NASDAQ:MSFT) would fall into that category. A going concern since it was founded by Bill Gates and Paul Allen in 1975, Microsoft is today a highly diversified tech giant that has a market capitalization of almost $3 trillion and is involved in everything from cloud computing to video games, not to mention its suite of popular software products. Despite being a stable legacy technology company, Microsoft continues to find new growth areas.

The biggest and most important growth area for Microsoft is in artificial intelligence (AI). The company has invested more than $10 billion in privately held OpenAI and is incorporating AI technologies across its products and platforms, from the Bing search engine and Teams conference call platform to its cloud computing services and Xbox video games. It’s all helping to keep Microsoft a leading and relevant tech concern whose stock has increased 60% this year and is up 244% over five years.

Microsoft is also one of the few mega-cap tech stocks that pays shareholders a quarterly dividend. The dividend currently stands at 75 cents a share each quarter for a yield of 0.79%.

On the date of publication, Joel Baglole held a long position in MSFT. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.