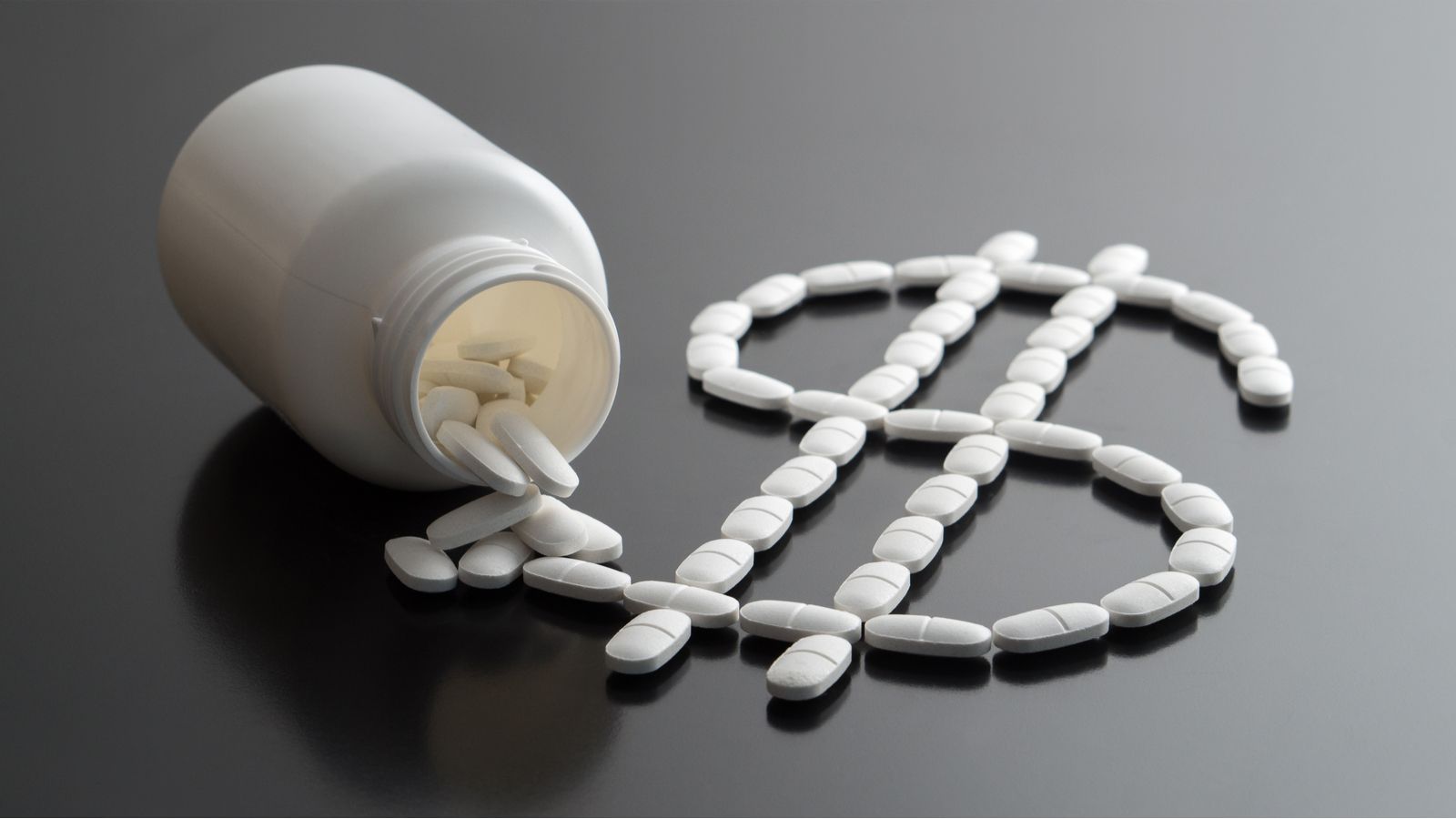

Weight-loss drugs are taking the U.S. by storm.

JPMorgan Chase (NYSE:JPM) is forecasting that the market for weight-loss medications could reach $100 billion in annual sales. The new class of drugs, known as “incretins,” has been shown in clinical trials to suppress appetite and reduce food intake. This, in turn, leads to dramatic weight loss without the need for diet and exercise.

The popularity of weight-loss medications is rising as well-known personalities ranging from Elon Musk to Amy Schumer tout their benefits. Many of the weight-loss medications stem from already approved diabetes drugs. Some haven’t yet been approved by the U.S. Food and Drug Administration (FDA), but they are being prescribed off-label by many doctors to help people manage their weight.

Excitement is building around the potential health and financial benefits of these new weight-loss medications. We break it down pound for pound and offer three buzzworthy drug stocks worth their weight in gold.

Novo Nordisk (NVO)

Danish pharmaceutical company Novo Nordisk (NYSE:NVO) recently became Europe’s most valuable company. After its buzzy weight-loss drug Wegovy was made available in the United Kingdom, its stock went soaring.

Nova Nordisk’s market capitalization of $432 billion is now larger than the economy of Denmark where the company is headquartered. In the U.S., Novo Nordisk is now the 14th most valuable company in the S&P 500 index. It ranks between Walmart (NYSE:WMT) and UnitedHealth Group (NYSE:UNH).

Like most of the incretin-based weight-loss drugs, Wegovy was initially designed to help treat Type 2 diabetes. It has been approved to treat obesity in many jurisdictions around the world. In its recent forecast, JPMorgan said that Novo Nordisk, which also makes the weight-loss drug Ozempic, should end up controlling about half the global market for weight-loss medications, making it a prime beneficiary of the expected sales boom.

Over the last 12 months, NVO stock has gained 85%, bringing its five year growth to 308%. Clearly, investors would do well to add this stock soon.

Eli Lilly (LLY)

Indiana-based Eli Lilly (NYSE:LLY) is the other pharmaceutical company that’s expected to control 50% of the weight-loss drug market. JPMorgan forecasts that LLY could achieve $50 billion in annual sales from its weight-loss drugs by 2030.

Eli Lilly’s drug Mounjaro, which treats diabetes, is currently being evaluated by the FDA as a weight-loss treatment. A decision is expected from the pharmaceutical regulator by year’s end. However, already Mounjaro is pushing Eli Lilly’s sales and stock to new heights. In August, LLY reported that this year’s Q2 profit rose 85% year over year (YOY) and revenue increased by 28% YOY due to surging sales of Mounjaro.

Sales of the weight-loss drug, which is delivered as an injection, grew an incredible 6,000% to $979.7 million from $16 million in the same period of 2022. This for a prescription medication that has not even been approved to treat obesity. Not surprising, Eli Lilly raised the forward guidance on its future earnings.

LLY stock has increased 60% so far this year and gained 453% over the past five years, making it one to buy now.

Pfizer (PFE)

Pfizer (NYSE:PFE) is trailing in the race to bring weight-loss treatments to market.

However, the company is determined to create an obesity drug in the form of a pill. Company executives firmly believe this method will be more appealing to consumers instead of administering needle injections.

PFE recently announced that it was canceling development of one obesity pill because of issues related to liver safety. However, it’s still developing its other obesity pill, the twice-daily treatment Danuglipron, anticipated to be a success with consumers.

Pfizer CEO Albert Bourla has said that Danuglipron could eventually be a $10-billion per year product for the company. As so, the pharma giant is finalizing plans for late stage development of Danuglipron with hopes of having the pill in trials by year’s end.

For Pfizer, the stakes are high. The company’s hugely successful drug against Covid-19 led to record sales in 2022. Hoever, it’s since fallen off a cliff, leaving analysts asking, “what’s next?” for Pfizer.

PFE stock has fallen 33% this year, driven almost entirely by slumping sales of its Covid-19 medications. Over five years, the share price is down 16%, making it one to buy now.