Now is a great time for investors to scoop up shares in lithium stocks. The spot price of lithium carbonate and spodumene seems to have hit the bottom. Prices are beginning to return to the upside. Also, inventories are decreasing, which means there could be a positive short-term catalyst in store for investors.

These developments have unfolded in China, which, as Market Index describes it, is the one country in the world that can make or break lithium prices. So, to take advantage of this situation, I’ve researched three lithium stocks that could lead to substantial gains for investors later this year and beyond. Here are three lithium stocks to buy.

Enovix (ENVX)

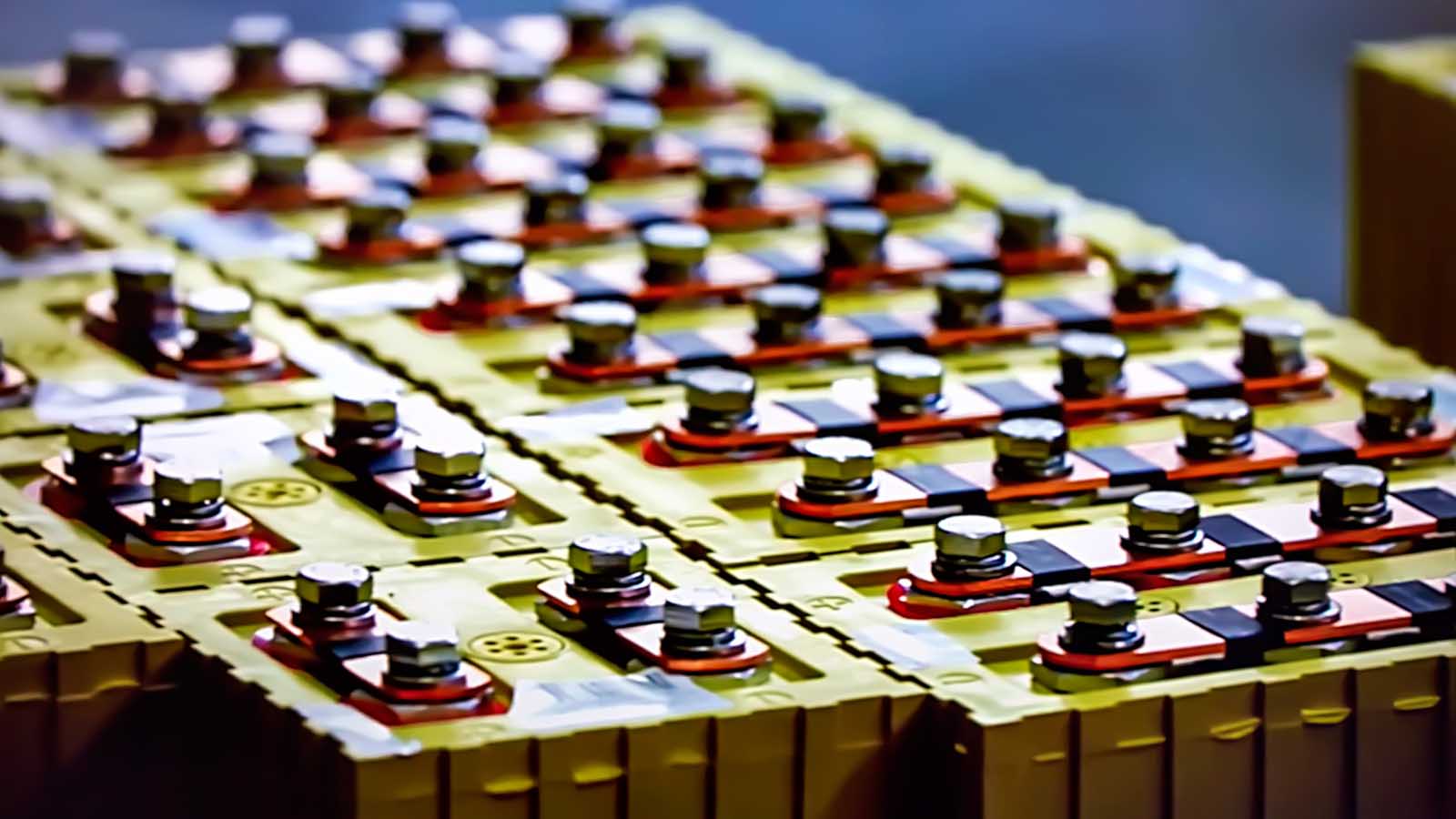

Enovix (NASDAQ:ENVX) is focused on developing and manufacturing silicon-anode lithium-ion batteries. These batteries are positioned strongly in the market. The benefits they offer are that they offer higher energy density, longer lifespan and faster charging capabilities.

I think that ENVX could be in a great position this year, with multiple positive developments on the horizon. Notably, it’s poised to transition to high-volume production in Malaysia. It’s also working hard to bring another facility online as well.

The stock has climbed up 45.36% over the past year, amid its revenue surging 2,400% last quarter to $200,000. Wall Street is very bullish on ENVX. The upside for its stock price is estimated to be 109.29%, and it also enjoys a “Strong Buy” rating.

QuantumScape (QS)

QuantumScape (NYSE:QS) specializes in the development of solid-state lithium batteries and is rocketing toward commercialization.

This year, QS stock is focused on QSE-5 cells and getting them ready to hit the market. Specifically, the company is concentrating on customer prototype testing, particularly with automotive OEMs, for its QSE-5 development.

The company’s results from its prototypes have so far been significant. It claims that the performance of its A0 prototype cells outperforms other batteries under normal circumstances.

It should be noted that QS stock is a speculative, long-term play. Wall Street expects that its revenues could reach an inflection point at around FY2026, growing to $146.60 million and then a staggering $1.38 billion in FY2028.

But for those with a high risk tolerance, QS stock could one day become a multi-bagger, which makes it one of those lithium stocks to buy.

Rivian Automotive (RIVN)

Rivian Automotive (NASDAQ:RIVN), an electric vehicle manufacturer, has been a notable player in the lithium market due to its focus on EVs.

Now is a good time to buy into RIVN stock, in my opinion. The reason is that it exceeded its production expectations for 2023, with a total of 57,232 vehicles produced, surpassing the management’s most recent full-year guidance of 54,000 vehicles.

Something else investors can look forward to is that the company plans to unveil the R2, a smaller and more affordable next-generation vehicle, on March 7. The R2 is expected to be priced around $40,000 due to its smaller design, and it’s also eligible for certain Inflation Reduction Act tax credits.

Despite a series of recent downgrades for the company, the opinion on Wall Street is that it’s still a “Buy.” It has a price target of $25.05, which represents a 53.40% upside at the time of writing.

On the date of publication, Matthew Farley did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.